"Informed AI News" is an AI-curated publications aggregation platform, ensuring you access only the most valuable information, with the aim of eliminating the information gap and transcending the confines of information cocoons. Find out more >>

AI and PC Industry: Nvidia's Rise and Intel's Challenges

- summary

- score

Summary and Insights:

AI and PC Industry Dynamics: At Computex, leading chip manufacturers demonstrated AI-driven innovations for PCs, seeking to rejuvenate a market that has seen a decline. Gartner's data indicates a 14.8% decrease in worldwide PC shipments for 2022.

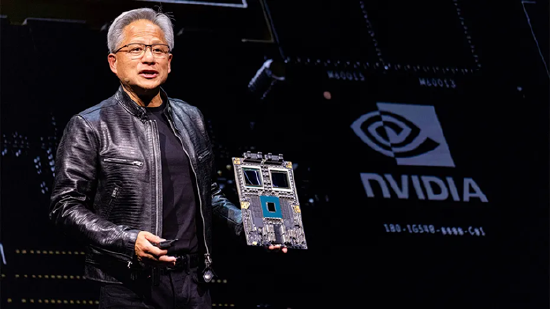

Nvidia's Ascendance: Nvidia, under the leadership of CEO Huang, announced plans for future AI chips, questioning the sustainability of Moore's Law. The company's strong position in AI processors has led to a remarkable 550% increase in stock value, achieving a market capitalization of $3 trillion.

Intel's Struggles: Conversely, Intel is grappling with difficulties, experiencing a 36% drop in stock value this year. CEO Gelsinger has defended Intel's position, introducing new processors such as "Xeon 6" and "Lunar Lake" to boost AI functionality and efficiency.

Arm and AMD's Rise: Arm and AMD are on the rise, with Arm forecasting a 50% market share in Windows PCs by 2027. AMD, which was once overshadowed by Intel, now has a market cap double that of Intel.

Industry Shift and Intel's Strategy: The PC chip industry is transitioning from x86 to Arm architectures, prompting Intel to consider manufacturing chips for Arm to stay competitive. This reflects a broader strategy by Gelsinger to revitalize Intel through diversification and innovation.

Personal Insights: The rapid evolution of the tech industry emphasizes the need for ongoing innovation. Intel's challenges serve as a reminder of the dangers of complacency in an industry where competitors can rapidly alter market dynamics. Nvidia's success exemplifies the benefits of visionary leadership and strategic flexibility. As AI transforms computing, companies must adapt to avoid becoming obsolete.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | Content provides a balanced overview of industry dynamics and company strategies. |

| Social Impact | 4 | Content influences public opinion on tech industry trends and company performance. |

| Credibility | 5 | Content is credible, backed by industry data and company announcements. |

| Potential | 5 | Content highlights potential shifts in tech industry, impacting future market dynamics. |

| Practicality | 4 | Content offers insights applicable to industry stakeholders and investors. |

| Entertainment Value | 3 | Content is informative but lacks direct entertainment elements. |