"Informed AI News" is an AI-curated publications aggregation platform, ensuring you access only the most valuable information, with the aim of eliminating the information gap and transcending the confines of information cocoons. Find out more >>

BOJ's Potential Shift to Quantitative Tightening Under Scrutiny

- summary

- score

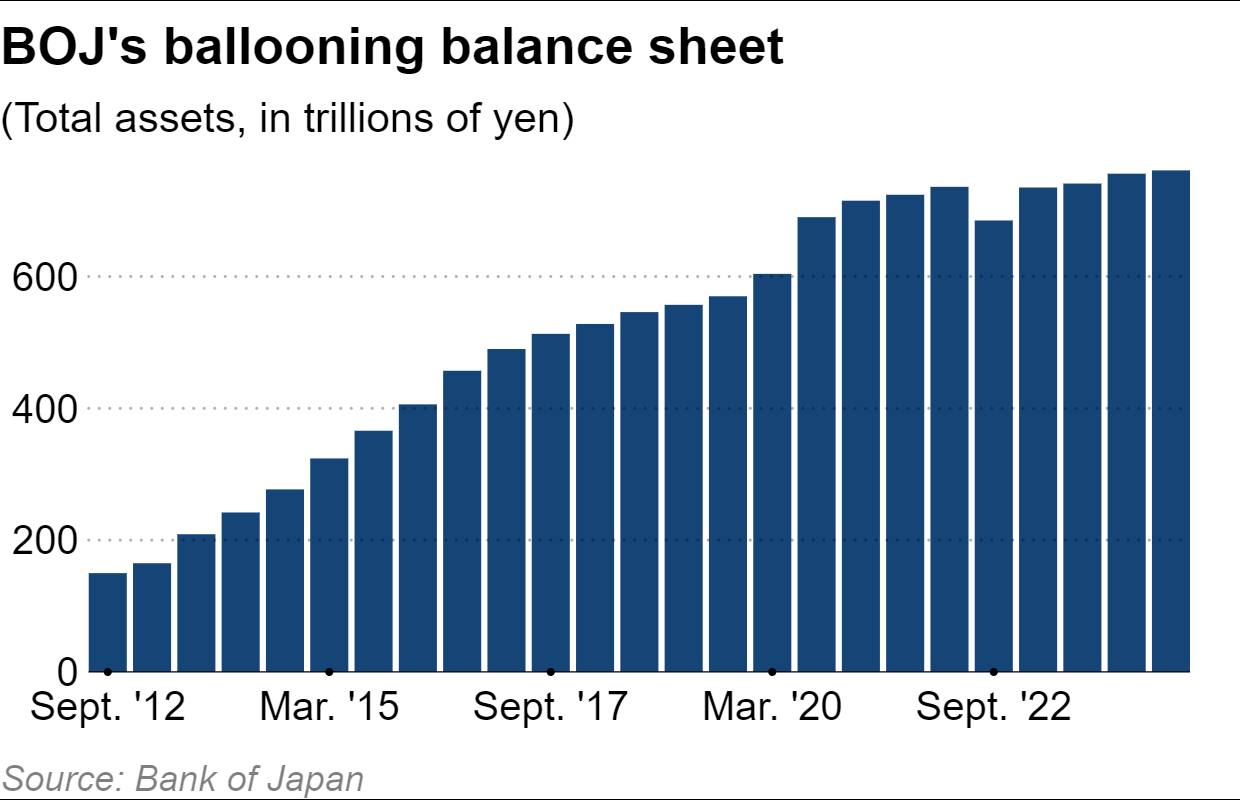

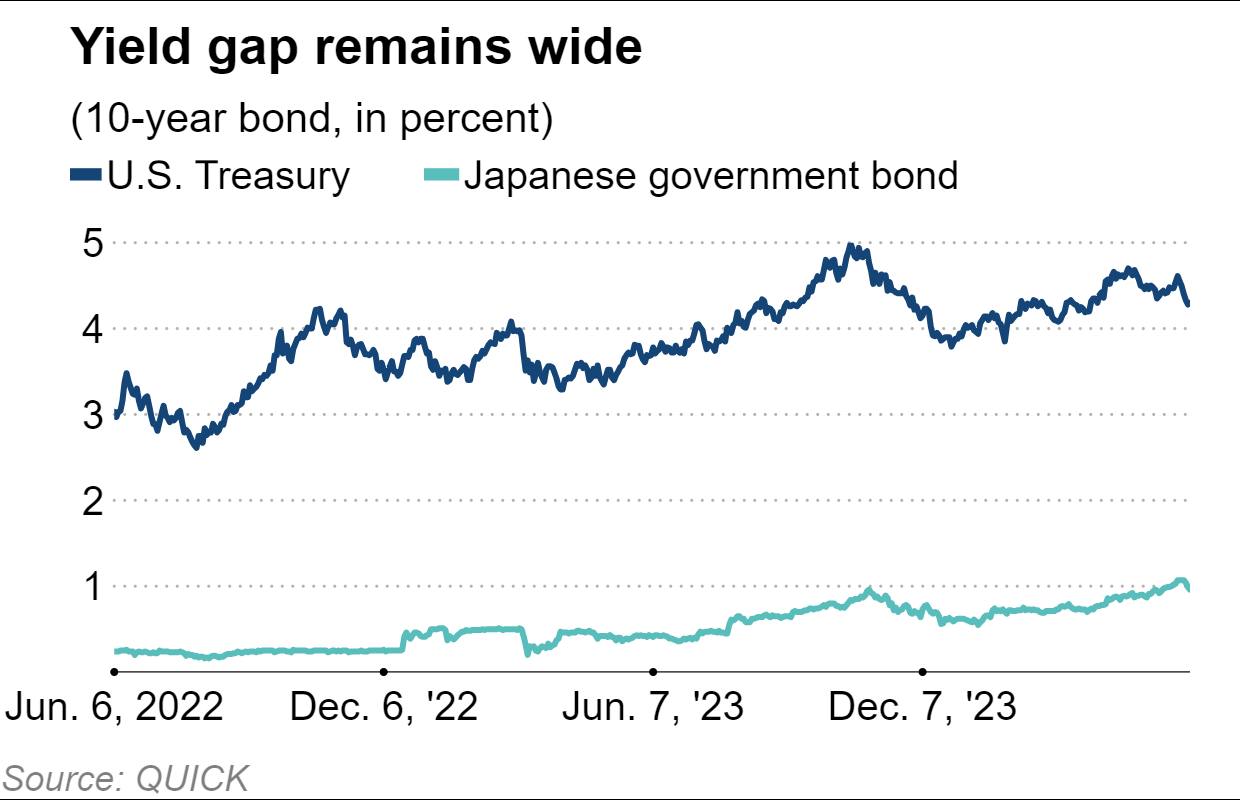

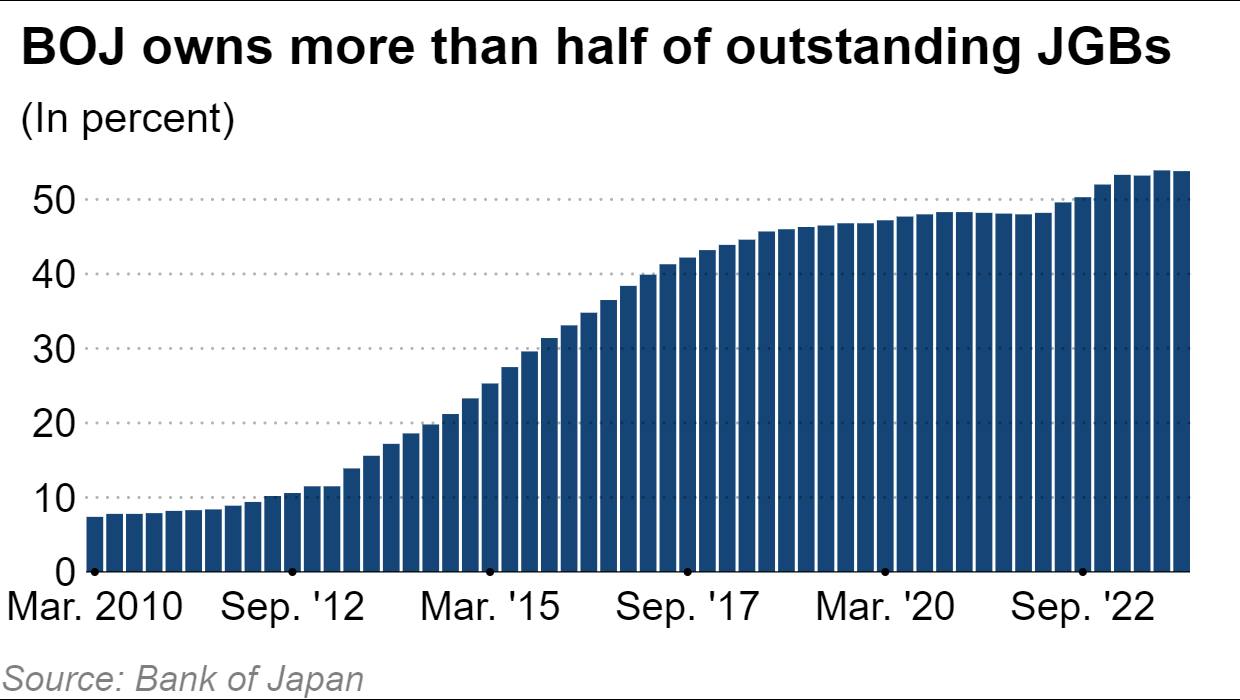

The Bank of Japan (BOJ) is under scrutiny as it contemplates reducing bond purchases, a move that might herald the onset of quantitative tightening. Economists predict a decrease from the current 6 trillion yen monthly purchases, with the goal of stabilizing the yen, which recently reached a 34-year low against the dollar. The BOJ's balance sheet, historically expanded to stimulate the economy, may now shrink, indicating a shift in monetary policy under Governor Kazuo Ueda.

Market anticipation centers on a reduction in bond purchases, with particular attention on the scale and timing of such a move. A substantial cut could push bond yields higher, complicating the BOJ's mission to preserve economic stability. Economists are split on whether this signifies the start of quantitative tightening, with some seeing any reduction as a move towards a smaller balance sheet.

Ueda's careful approach, stressing gradual policy adjustments to prevent economic disruption, highlights the intricate balance between market expectations and government intervention. As the BOJ confronts these challenges, its actions will be closely observed for indications of a new monetary era.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | Content provides a balanced overview of the BOJ's potential actions and market reactions. |

| Social Impact | 4 | Content discusses a significant economic policy shift that could influence public opinion. |

| Credibility | 5 | Content is based on economic analysis and expert opinions, suggesting high credibility. |

| Potential | 5 | The BOJ's actions could significantly impact the economy and financial markets. |

| Practicality | 4 | Discusses practical implications of monetary policy changes on the economy. |

| Entertainment Value | 2 | While informative, the content lacks typical entertainment elements. |