"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

G20 Advances Plan to Tax Ultra-Rich Individuals

- summary

- score

The G20 has just moved closer to taxing the ultra-rich, with a proposed 2% levy on wealth exceeding $10 billion. This concept, promoted by Brazil, could potentially generate $2500 billion annually.

The journey towards implementing this "wealth tax" has been challenging. While France supports it, the U.S. has been cautious. The main obstacle is enforcement; tax havens and sophisticated loopholes make it difficult to tax the super-rich effectively.

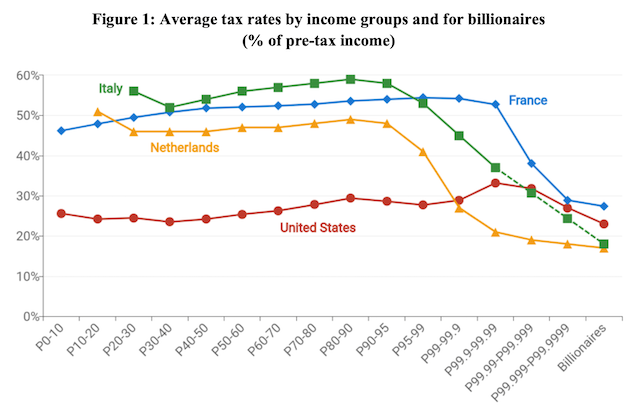

The proposal, developed by economist Gabriel Zucman, points out a significant disparity: billionaires often pay less tax than ordinary citizens. In France, for example, billionaires pay only 27% of their income in taxes, compared to nearly 52% paid by most people.

The G20 recognizes that tax evasion by the wealthy undermines fairness and is preparing to intensify efforts. However, this requires complex international cooperation and domestic reforms.

The road ahead is arduous. Agreeing on a global wealth tax is a long-term endeavor, not a quick fix. The success of the global minimum corporate tax, set at 15%, provides a model, but taxing personal wealth is more complex and will take longer.

Ultimately, the G20's move to tax the super-rich represents a historic shift, but the true challenge lies in execution. It is a significant step towards balancing the economic playing field.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | Comprehensive reporting and in-depth analysis. |

| Social Impact | 5 | Significantly influencing public opinion. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 5 | Almost certain to trigger a larger event. |

| Practicality | 4 | Highly practical, applicable to real problems. |

| Entertainment Value | 2 | Includes a few entertaining elements. |