"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

Global Central Banks Increasing Gold Reserves Amid Economic Uncertainties

- summary

- score

Central banks worldwide are shifting away from the dollar and yuan, turning to gold as their reserve of choice. This move reflects growing geopolitical tensions and economic uncertainties. The dollar's share in global foreign reserves has dipped to historic lows, currently at 58.9%.

Russia's invasion of Ukraine and subsequent U.S. sanctions have pushed emerging economies to favor gold, a 'stateless currency' not tied to any specific nation. This shift underscores global fragmentation.

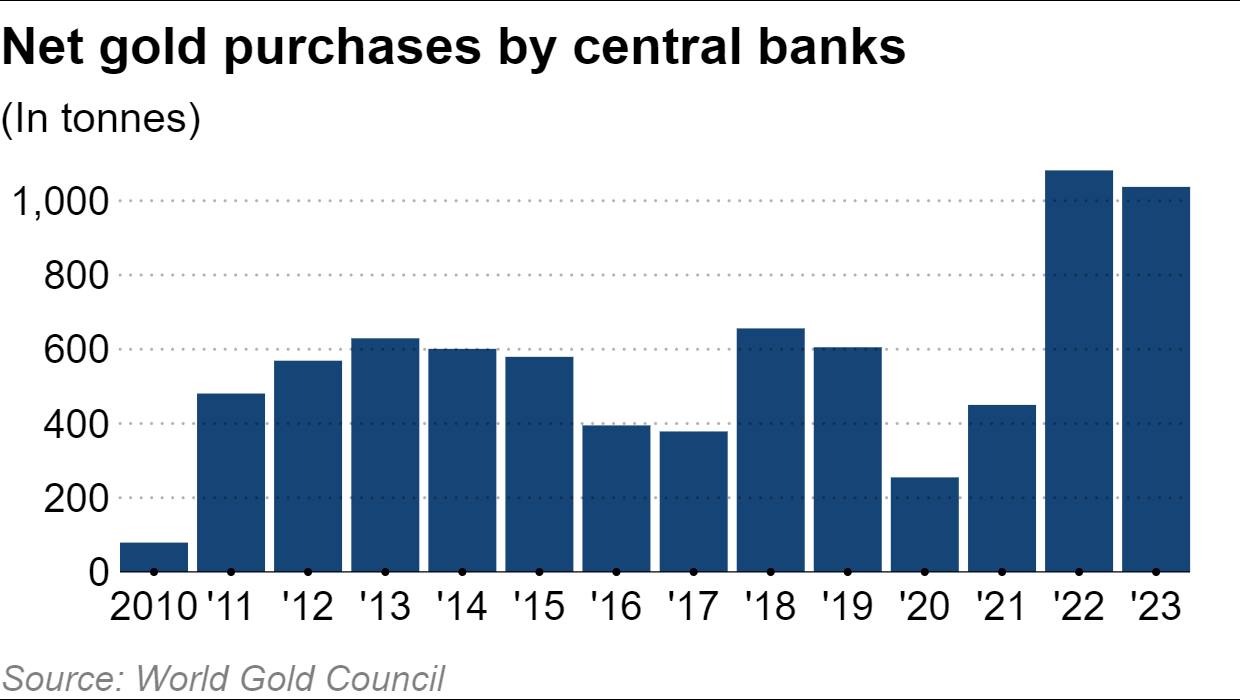

Gold purchases by central banks have surged, with net purchases reaching 1,030 tonnes in 2023, following a record 1,082 tonnes in 2022. Countries like China, Brazil, and India are increasing their gold reserves while reducing their reliance on the yuan.

The trend towards gold reflects a broader move away from currencies linked to specific nations, driven by concerns over financial stability and geopolitical risks. As tensions persist, gold's appeal as a stable, independent asset continues to grow.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | Comprehensive reporting with in-depth analysis. |

| Social Impact | 5 | Significantly influencing public opinion on global finance. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 5 | High potential to trigger economic shifts. |

| Practicality | 4 | Highly practical, applicable to real economic scenarios. |

| Entertainment Value | 2 | Slightly monotonous, few entertaining elements. |