"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

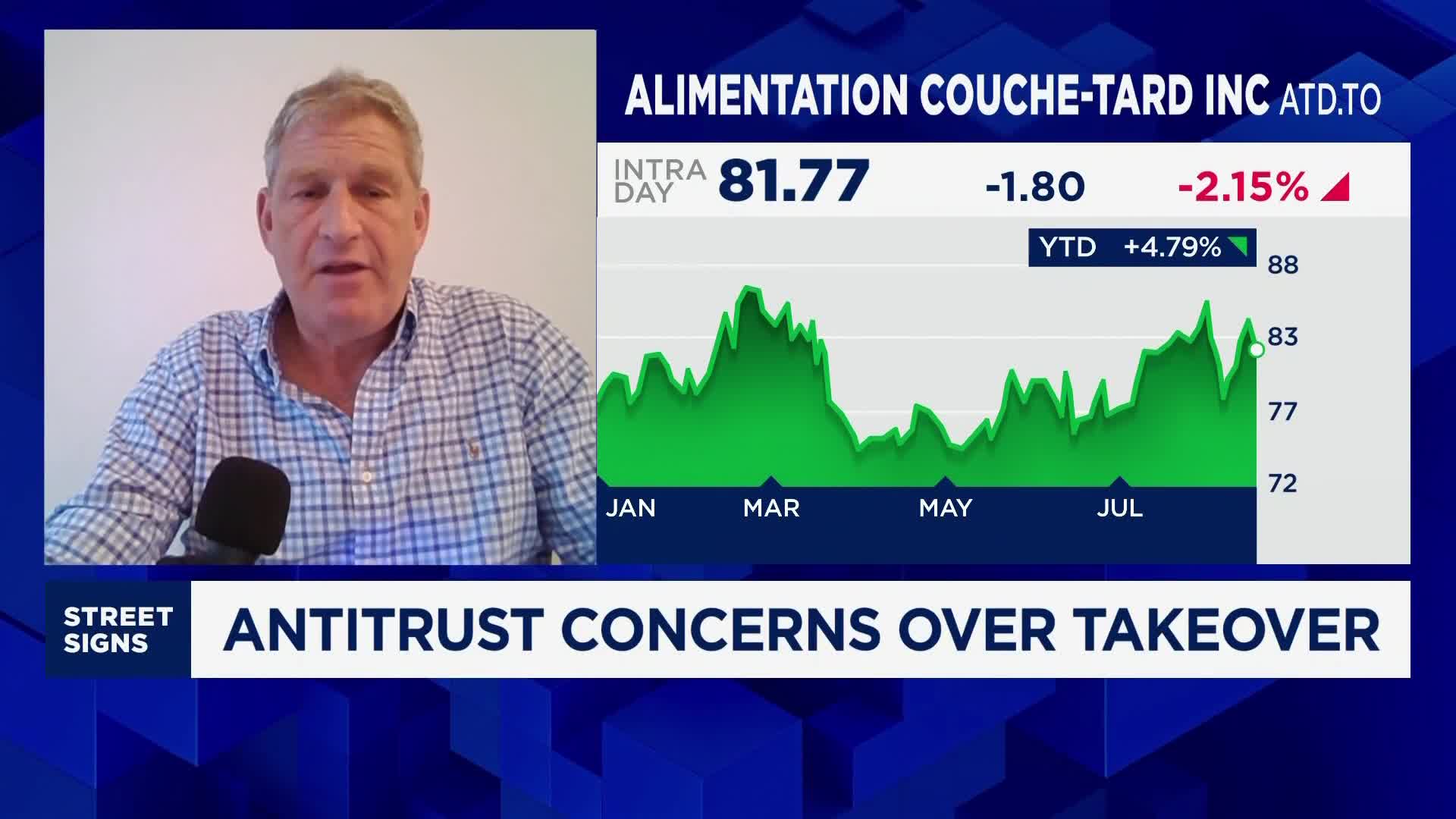

Proposed 7-Eleven Buyout Faces Antitrust Scrutiny

- summary

- score

Alimentation Couche-Tard, operator of Circle K, has proposed acquiring Seven & i Holdings, the owner of 7-Eleven. This deal is under scrutiny for potential antitrust issues, particularly in the U.S., where both brands hold significant market shares. Retail analyst Bryan Gildenberg anticipates regulatory challenges and possible asset sales to facilitate the merger.

The combination would form a retail behemoth, controlling 12.3% of the U.S. convenience store market. This level of dominance is particularly concerning in regions like Florida and Texas, where there are substantial store overlaps. Although Couche-Tard has fewer global outlets (16,700 compared to 85,800), its higher market valuation ($57 billion versus $38 billion) indicates strong investor confidence.

Should the acquisition be approved, it would represent the largest foreign takeover of a Japanese firm, providing access to Japan's extensive but largely untapped retail sector. Couche-Tard's recent purchase of GetGo highlights its commitment to enhancing food services, an area of strength for both GetGo and 7-Eleven.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | Comprehensive reporting with in-depth analysis. |

| Social Impact | 4 | Strong social discussion, influencing some public opinion. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 5 | Very high potential to trigger a larger event. |

| Practicality | 4 | Highly practical, applicable to real problems. |

| Entertainment Value | 3 | Some entertainment value, attracts a portion of the audience. |