info

"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

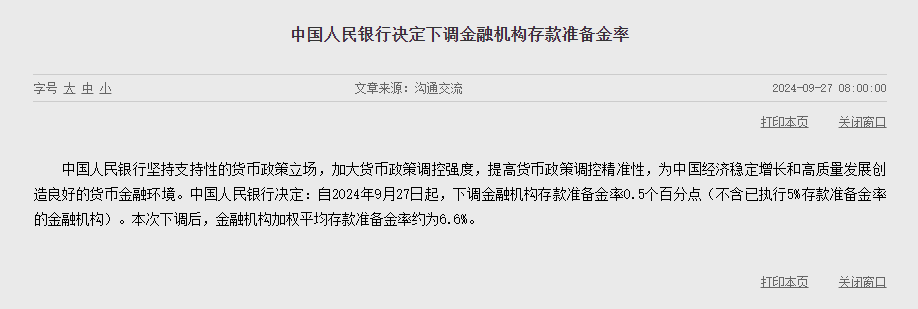

The central bank's policy of lowering the reserve requirement ratio and interest rates has been implemented to support stable economic growth.

- summary

- score

The central bank announced a reduction in the reserve requirement ratio and interest rates, lowering the deposit reserve ratio by 0.5 percentage points and the 7-day reverse repo rate by 0.2 percentage points. This move aims to enhance the intensity of monetary policy regulation and support stable economic growth. The central bank stated it will continue to introduce incremental financial policies, strengthen departmental coordination, and promote sustained economic recovery.

Explanation:

- Reserve Requirement Ratio Cut: Reduces the bank deposit reserve ratio, freeing up more funds for lending.

- Interest Rate Cut: Lowers interest rates to encourage borrowing and investment.

- Reverse Repo: The central bank injects short-term funds into the market to adjust liquidity.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | 内容客观,全面报道和深入分析。 |

| Social Impact | 5 | 引发广泛社会讨论,显著影响公众意见。 |

| Credibility | 5 | 完全可信,权威来源,证据充分。 |

| Potential | 6 | 极高潜力,几乎必然导致重大变化。 |

| Practicality | 5 | 极其实用,广泛应用于实践并取得良好效果。 |

| Entertainment Value | 1 | 内容枯燥,缺乏吸引力。 |