"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

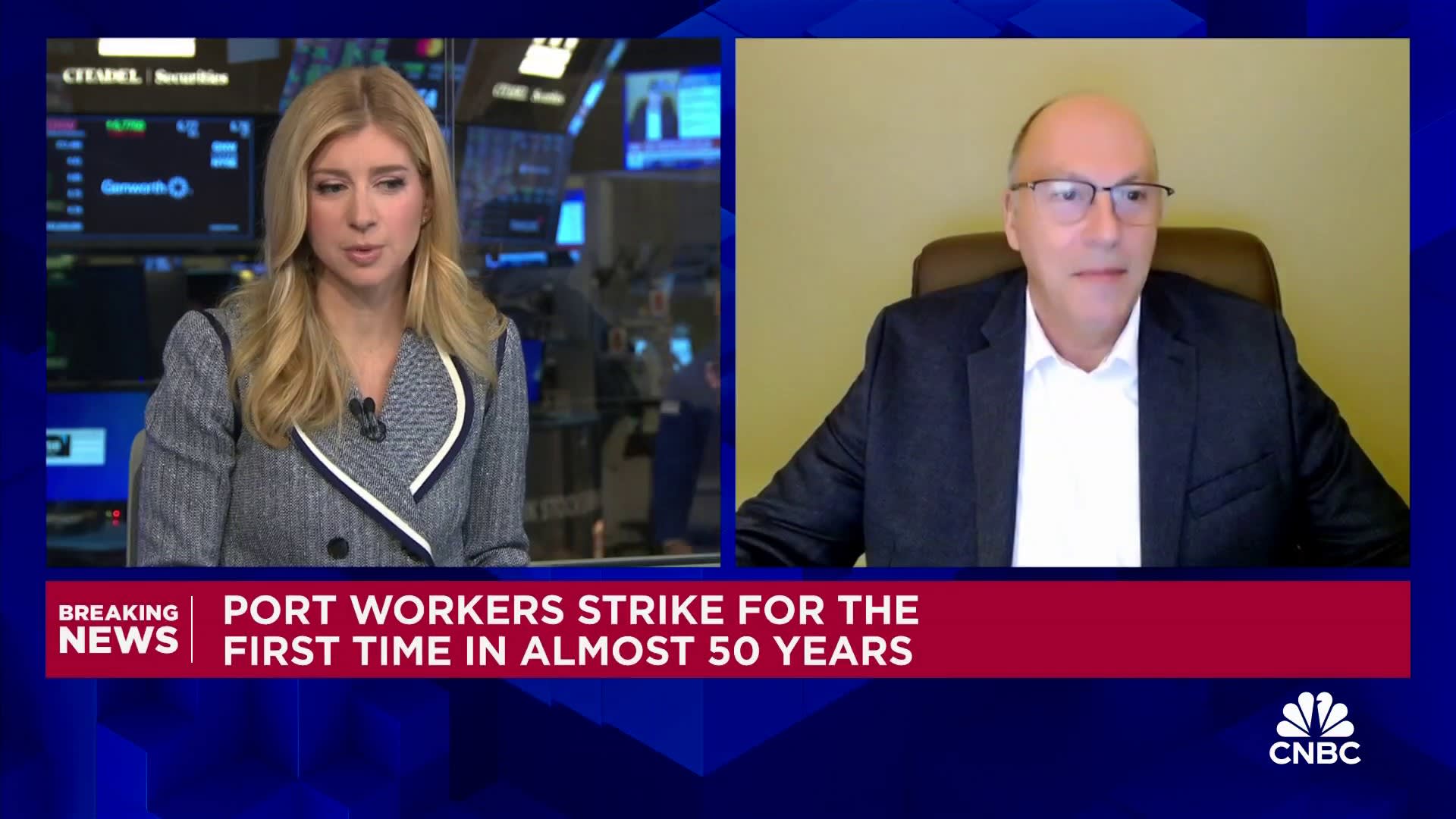

Massive Port Strike Threatens U.S. Economy and Consumer Prices

- summary

- score

Dockworkers at 14 U.S. East and Gulf Coast ports went on strike October 1, 2024, demanding wage increases and opposing automation. The strike threatens $3 trillion in annual trade, potentially devastating the economy.

Matthew Shay, National Retail Federation CEO, warns of higher consumer prices due to limited supplies and increased demand for imported goods. The strike comes amid a fragile economic recovery and post-Hurricane Helene hardship.

Inflation has slowed but not reversed; August's consumer price index rose 2.5% year-over-year. Lauren Saidel-Baker, ITR Economics economist, predicts the strike could reignite goods-side inflation.

The strike echoes the 2020 pandemic supply chain crisis, where goods shortages drove up prices. Lisa DeNight, Newmark managing director, emphasizes that the strike's duration amplifies its impact.

Amir Mousavian, University of New England supply chain professor, notes that perishable goods like coffee and bananas will see immediate price hikes. Longer strikes could raise costs for pharmaceuticals, apparel, and automobiles, ultimately burdening consumers.

The timing—ahead of the holiday season and U.S. elections—adds urgency. The Federal Reserve's recent rate cut aimed to ease living costs, but a prolonged strike could force a policy rethink.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | Balanced reporting with comprehensive analysis. |

| Social Impact | 6 | Extensive discussion, major impact on public opinion. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 6 | High potential to trigger significant economic changes. |

| Practicality | 4 | Highly practical, directly applicable to real problems. |

| Entertainment Value | 2 | Slightly monotonous, few entertaining elements. |