"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

Singapore Tightens Screening for Wealthy Chinese Family Offices Amid Financial Crime Concerns

- summary

- score

Singapore, a magnet for wealthy Chinese, is tightening its screening of family offices. These offices, which manage assets for high net worth families, now face stricter vetting by the Monetary Authority of Singapore (MAS) and external auditors. The crackdown follows a money laundering scandal involving Chinese nationals, dubbed the "Fujian gang," whose assets worth over $2.34 billion were seized.

Previously, MAS handled most screening duties. But with the surge in family offices—which enjoy tax breaks in exchange for investing in Singapore—and rising concerns over financial crime, MAS has enlisted outside help. This includes EY’s Forensic and Integrity Services unit, which scrutinizes applicants for ties to money laundering, terrorism financing, or other offenses.

The enhanced screening aims to protect Singapore’s reputation as a regional wealth hub. Mandeep Nalwa, CEO of Taurus Wealth, notes that while Singapore attracts clean money, some seek to launder ill-gotten gains, hoping to gain credibility once based in the city-state.

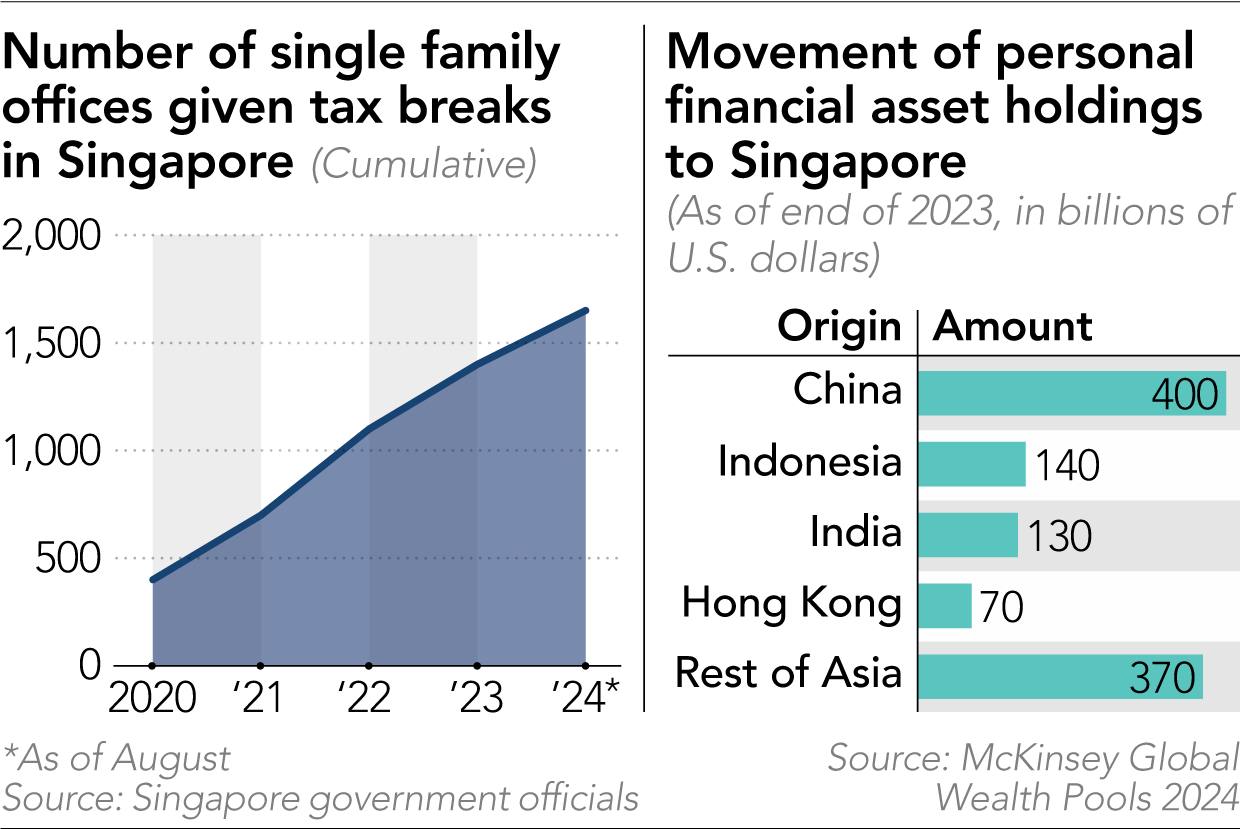

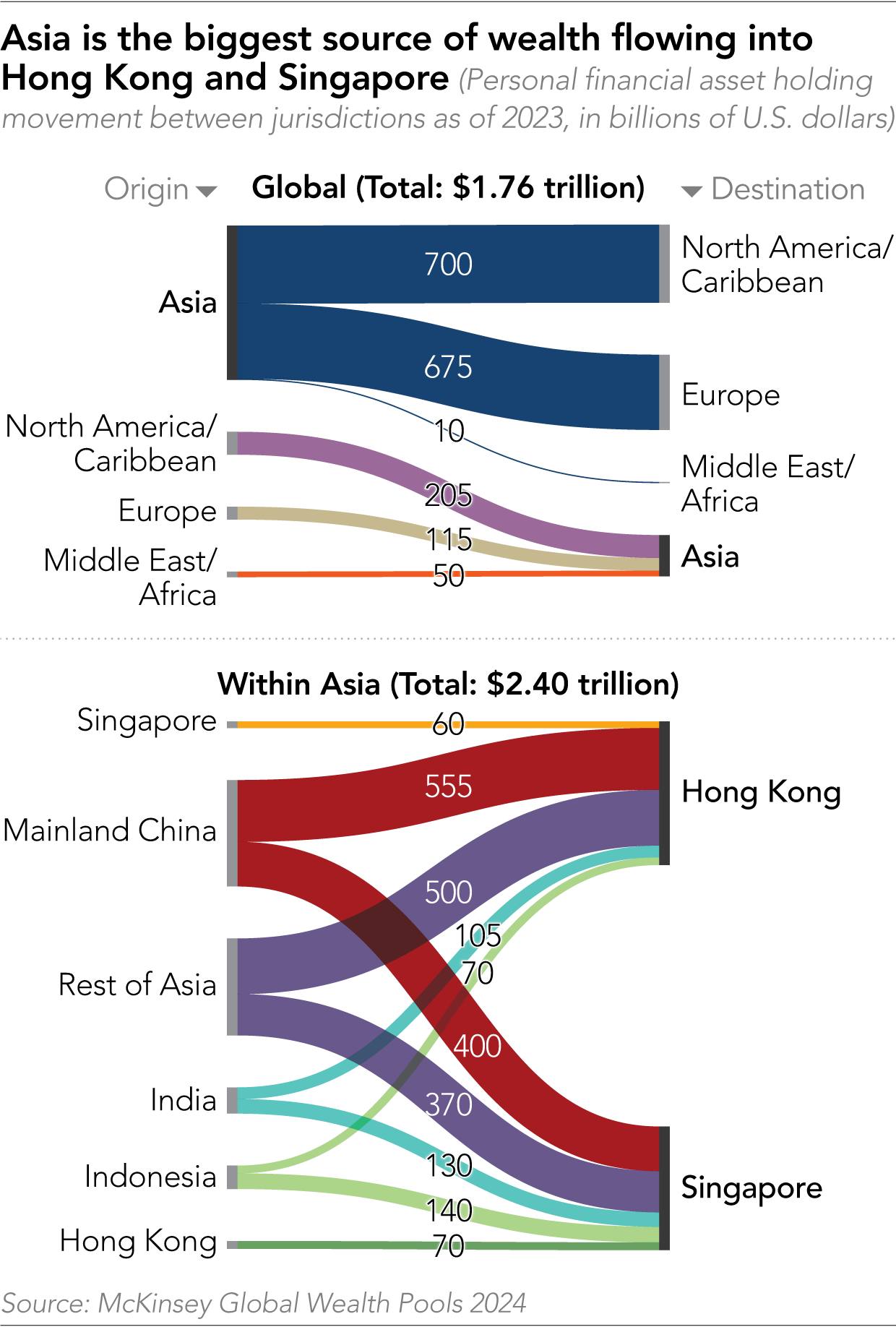

Singapore’s tightening measures reflect broader concerns about financial crime tarnishing its image. Tim Peters of Enghouse Systems warns that any significant scandal could deter future investments. McKinsey’s analysis highlights the scale of wealth movement to Singapore, totaling $400 billion from China alone by the end of 2023.

The city-state’s popularity as a family office hub is evident, with the number rising from 400 in 2020 to 1,650 by August 2024. Singapore’s Second Finance Minister expects this year’s new family offices to exceed 300. The challenge lies in balancing growth with stringent oversight to maintain its financial integrity.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | Comprehensive reporting and in-depth analysis. |

| Social Impact | 5 | Significantly influencing public opinion. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 5 | Almost certain to trigger a larger event. |

| Practicality | 4 | Highly practical and directly applicable. |

| Entertainment Value | 2 | Slightly monotonous but includes a few entertaining elements. |