"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

Ratan Tata's Transformation of Tata Group into a Global Conglomerate

- summary

- score

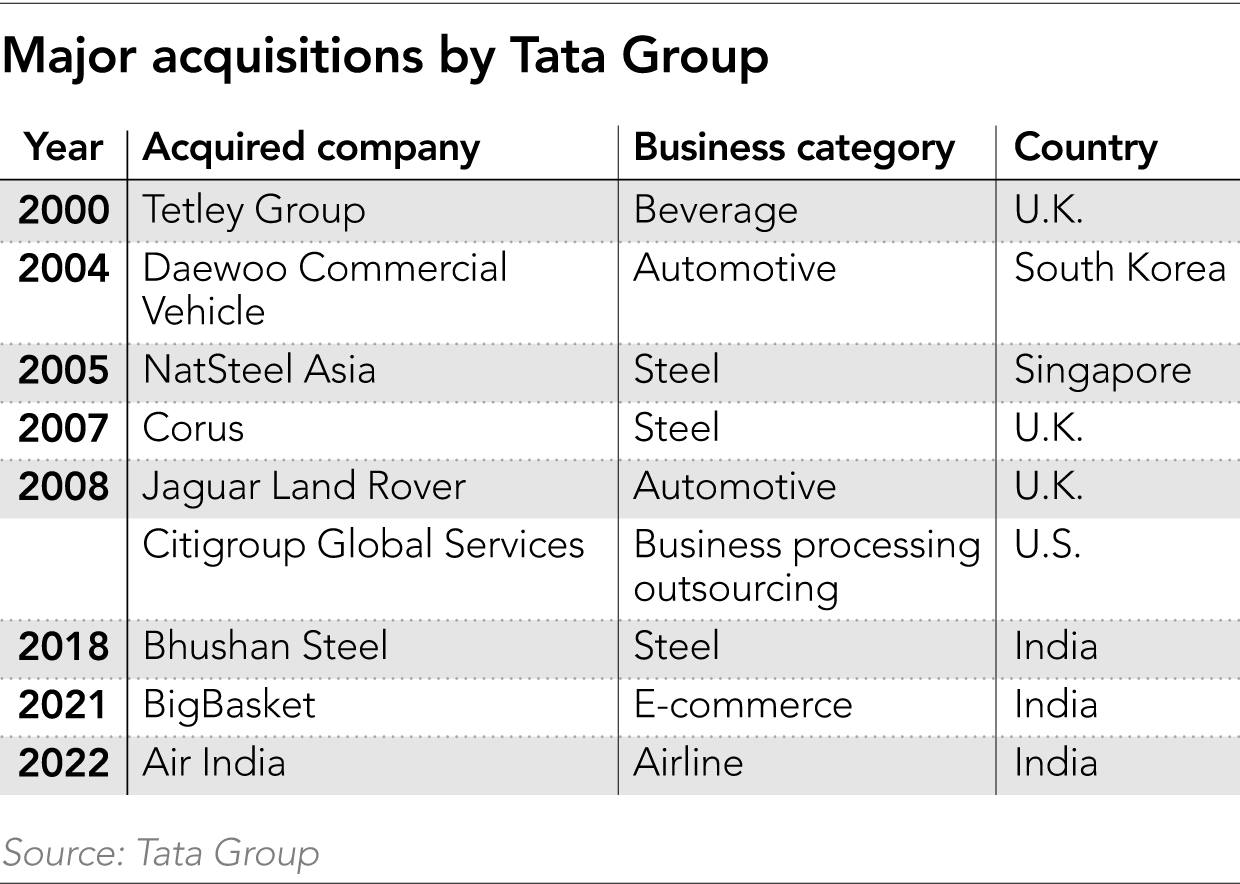

Ratan Tata transformed Tata Group into a global force. From 1991 to 2012, he spent $20 billion on over 50 acquisitions. Key purchases included British tea maker Tetley and Anglo-Dutch steelmaker Corus.

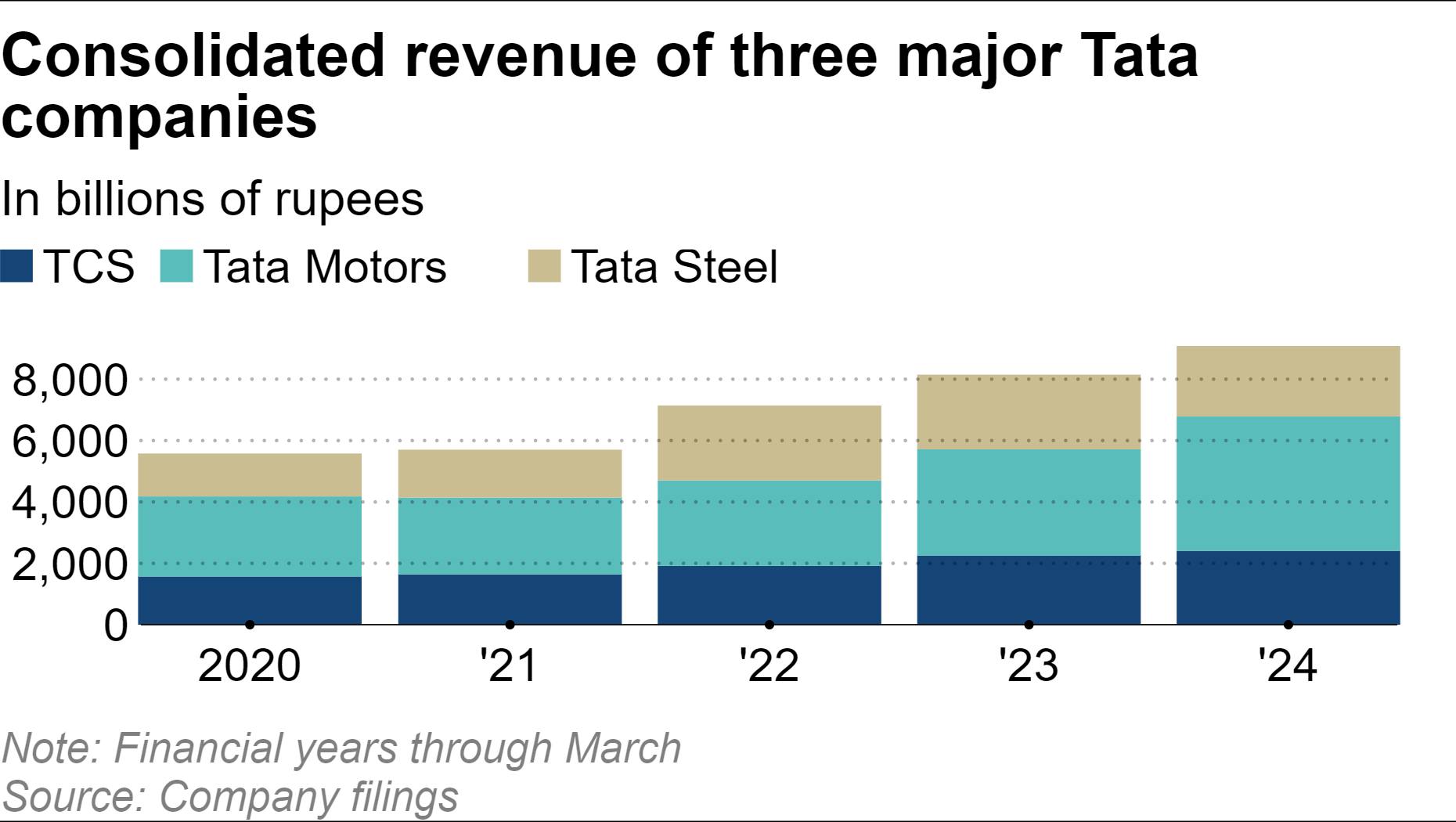

Tata’s vision was clear: global expansion. He saw potential in diverse sectors—steel, cars, consumer goods, technology. His strategy paid off. Tata Group’s revenue surged from $6 billion to $100 billion. International revenue reached $59 billion.

Not all deals were perfect. Corus, acquired for $12 billion, struggled post-2008 crisis. Yet, Tata’s foresight reshaped the conglomerate. He modernized the Tata brand, aligning it with the new economic era.

Liberalization in India, starting in 1991, empowered Tata. It allowed private investment, a stark contrast to earlier nationalization policies. This shift enabled Tata to venture globally as domestic business thrived.

Today, Tata Group is ubiquitous. It spans tea, cars, aviation, retail, semiconductors, and more. Global giants like Apple, Starbucks, and Zara partner with Tata for Indian operations.

Tata’s legacy is profound. He turned a trading company into a global conglomerate, setting the stage for future growth. His vision and boldness continue to define Tata Group’s trajectory.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | Comprehensive reporting and in-depth analysis. |

| Social Impact | 5 | Significantly influenced public opinion. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 5 | Almost certain to trigger larger events. |

| Practicality | 5 | Widely applied in practice with good results. |

| Entertainment Value | 2 | Slightly monotonous with a few entertaining elements. |