"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

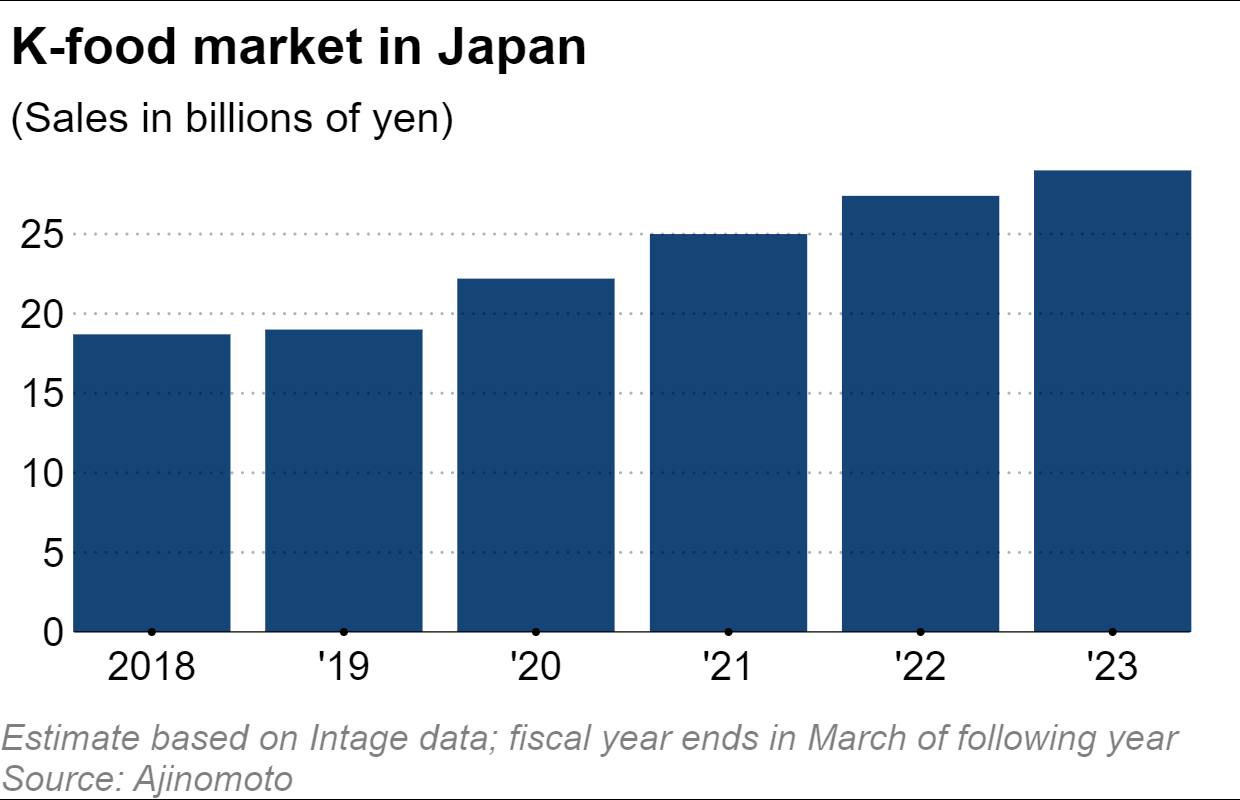

Korean Food Market in Japan Sees 50% Growth Over Five Years

- summary

- score

Japan's market for Korean food products has surged 50% over five years, driven by the popularity of Korean pop culture. CJ Foods Japan, a subsidiary of South Korean food maker CJ Cheiljedang, leads with its Bibigo brand, selling mandu dumplings, kimchi, and seasonings. The company introduced seven new frozen products in March, aiming to make Korean cuisine more accessible.

Daesang Japan, another South Korean food giant, entered the market with frozen kimbap in 2021. Sales have grown steadily, prompting plans to expand its product line. The company attributes this success to the exposure of Korean cuisine in dramas, making healthy dishes familiar to Japanese consumers.

The Korean food market in Japan reached 29 billion yen in fiscal 2023, according to Ajinomoto, a Japanese food processor. Ajinomoto itself has revamped its Cook Do Korea seasonings, focusing on authentic flavors that enhance rice dishes. NH Foods, known as Nippon Ham, launched K-Kitchen, a ready-to-eat Korean cuisine brand, in 2023.

South Korea’s government aims to nearly double the global market for Korean food by 2027. With domestic growth limited by falling birthrates, Korean food processors are aggressively expanding internationally.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | Balanced reporting with comprehensive data. |

| Social Impact | 4 | Influences public opinion on food trends. |

| Credibility | 5 | Solid evidence from authoritative sources. |

| Potential | 5 | High potential for continued growth. |

| Practicality | 4 | Highly practical for business expansion. |

| Entertainment Value | 3 | Some entertainment value in food trends. |