"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

Unveiling the Truth and Risks of "Zero Down Payment" and "Ultra-Low Down Payment" Home Purchases

- summary

- score

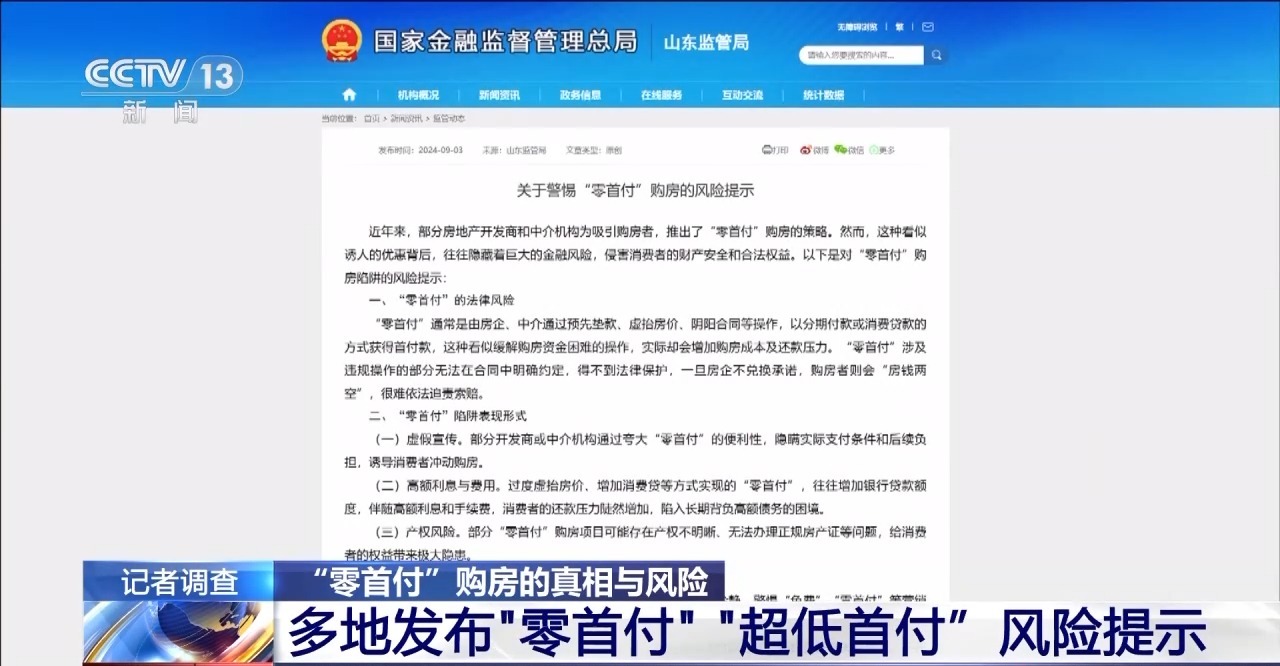

CCTV Investigation Reveals the Truth and Risks of "Zero Down Payment" and "Ultra-Low Down Payment" Home Purchases. Recently, many developers and intermediaries have introduced such promotions to attract homebuyers. However, these practices are actually illegal, circumventing down payment policies through methods such as inflating house prices and fronting loans.

Cities like Zhengzhou and Nanning have issued risk warnings, pointing out that "zero down payment" schemes hide significant financial risks that could harm consumer rights. For instance, a salesperson for a certain property promised a down payment of 20,000 yuan, but in reality, this was achieved through dual contracts and inflated house prices, increasing the bank loan amount.

After opting for "zero down payment," the monthly mortgage and interest payments for homebuyers significantly increase. Taking a 970,000 yuan house as an example, the monthly mortgage after a normal down payment is 3,865.32 yuan, while with "zero down payment," it rises to 4,547 yuan, an increase of 17.6%. The total interest also increases from 477,471 yuan to 561,731 yuan, an additional 84,000 yuan.

Moreover, inflating house prices can lead to additional taxes. Experts point out that "zero down payment" does not reduce the burden; the total amount paid remains the same, or even more.

Such practices are fraught with risks, easily leading homebuyers to misjudge their capabilities and increasing the risk of default. Banks also face challenges in their audits, needing to be vigilant against such illegal activities.

Key Term Explanations:

- Dual Contracts: Two contracts with different content for the same transaction, one for the actual transaction and the other for evading regulations or avoiding taxes.

- LPR Rate: Loan Prime Rate, the interest rate banks offer to their most creditworthy customers.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 6 | 内容非常客观,全面报道和深入分析。 |

| Social Impact | 5 | 内容引发广泛社会讨论,显著影响公众意见。 |

| Credibility | 5 | 内容完全可信,权威来源提供坚实证据。 |

| Potential | 6 | 内容具有极高潜力,几乎必然导致重大变化或事件。 |

| Practicality | 4 | 内容高度实用,可直接应用于实际问题。 |

| Entertainment Value | 2 | 内容略显单调,但包含一些娱乐元素。 |