"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

The Political Bureau of the CPC Central Committee meeting promotes the stabilization and recovery of the real estate market.

- summary

- score

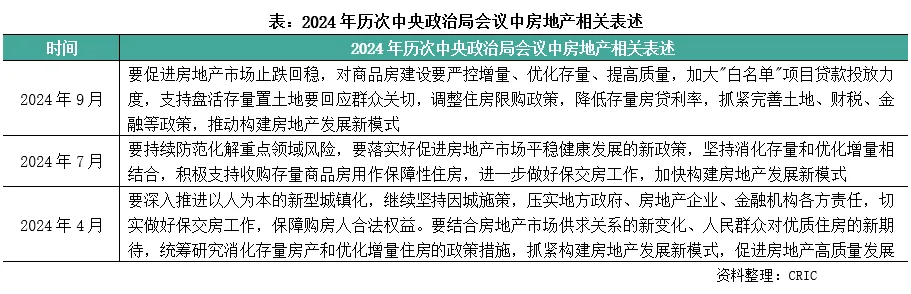

The Political Bureau of the CPC Central Committee convened a meeting on September 26, clearly stating the need to stabilize and reverse the decline in the real estate market. The meeting called for strict control over the increase in commercial housing construction, optimization of existing stock, improvement in quality, and increased lending for projects on the "white list" to support the revitalization of idle land. At the same time, addressing public concerns, it proposed adjustments to housing purchase restrictions, reductions in existing mortgage rates, and improvements to policies related to land, fiscal and taxation, and finance, to promote the establishment of a new model for real estate development.

The central rate of mortgage rates is expected to further decline, with the LPR likely to be cut by 20-25 basis points as soon as the October 20th LPR announcement, leading to a further downward shift in the central mortgage rate. Additionally, reductions in housing transaction taxes, including exemptions from deed tax, value-added tax, individual income tax, and other real estate transaction taxes, are intended to stimulate housing consumption.

Among first-tier cities, Guangzhou is most likely to be the first to fully lift purchase restrictions, followed by Shenzhen, while it is unlikely for Beijing and Shanghai to fully lift purchase restrictions. For second and third-tier cities, demand-side policies will mainly focus on incentives through credit policies, trade-in policies, and housing subsidies.

On the supply side, policies will promote the construction of high-quality residential properties, optimize floor area ratio rules to increase the actual usable area, moderately reduce the retention ratio for pre-sale funds of high-quality projects, encourage premium pricing, and no longer implement price guidance for new housing. Pilot projects for sales of completed properties will be advanced, with increased development loan quotas, extended loan terms, and reduced loan rates for such projects.

Note:

- LPR (Loan Prime Rate): The Loan Prime Rate is a type of interest rate in the Chinese interbank market.

- BP (Basis Point): A basis point is equal to 0.01%.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | 内容较为客观,平衡了不同观点。 |

| Social Impact | 5 | 内容引发广泛社会讨论,影响公众意见。 |

| Credibility | 5 | 内容完全可信,权威来源,证据充分。 |

| Potential | 6 | 内容具有极高潜力,几乎必然导致重大变化。 |

| Practicality | 5 | 内容极其实用,已在实践中广泛应用。 |

| Entertainment Value | 2 | 内容略显单调,但包含一些娱乐元素。 |