"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

U.S. debt interest payments hit a record high, intensifying fiscal deficit challenges.

- summary

- score

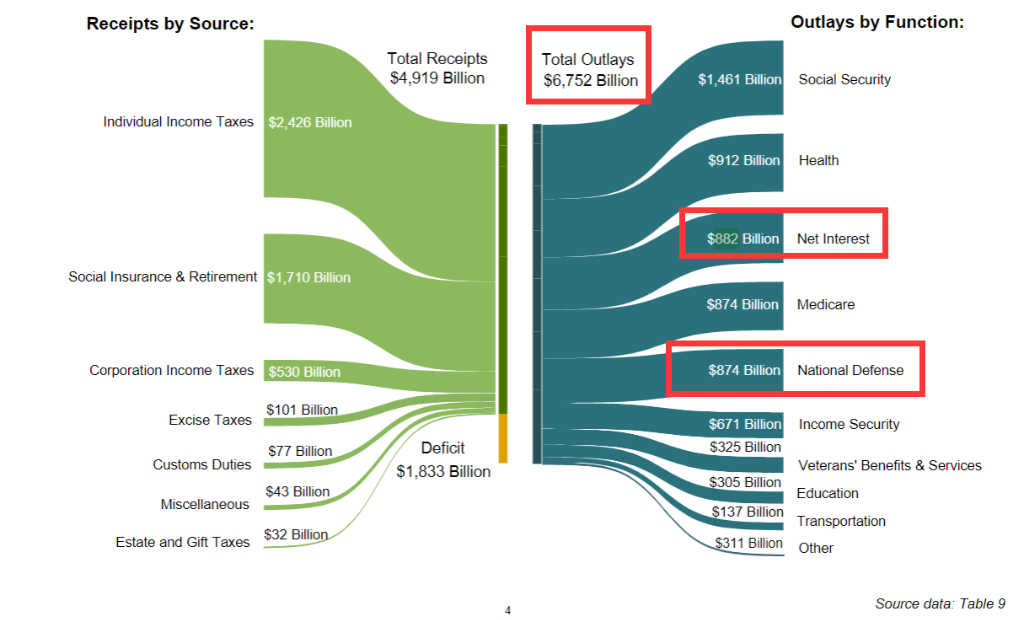

For the first time, U.S. interest payments on debt have exceeded defense spending, accounting for 18% of federal revenue and reaching a 28-year high. In fiscal year 2024, the federal government's budget deficit reached $1.833 trillion, with net interest payments on debt totaling $882 billion, equivalent to 3.06% of GDP.

The main drivers of the rising deficit include increased spending on Social Security and Medicare, massive expenditures during the pandemic, and the 2017 tax reform. High interest rates have exacerbated fiscal pressures, with the Federal Reserve maintaining interest rates at a two-decade high.

The substantial interest payments could crowd out private investment and hinder economic growth. The Congressional Budget Office estimates that for every dollar of deficit-financed spending, private investment decreases by 33 cents.

With the election looming, the budget deficit has become a challenge for presidential candidates. Economic policies of Harris and Trump could lead to rising prices and an expanded deficit. The Committee for a Responsible Federal Budget predicts that Harris's plan would increase debt by $3.5 trillion, while Trump's plan would increase it to $7.5 trillion.

A Federal Reserve rate cut could alleviate the debt problem, but it will take time. Over the next few years, as low-interest government bonds mature, repayment costs will rise. The aging population will also increase, leading to higher costs for Social Security and Medicare, and the budget deficit will remain substantial.

Investors are not currently overly concerned about the U.S. fiscal challenges, but the situation has changed. With rising interest rates, debt interest payments have significantly increased, and the era of "free lunch" is over.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | 内容较为客观,平衡了不同观点。 |

| Social Impact | 5 | 引发广泛社会讨论,影响公众意见。 |

| Credibility | 5 | 完全可信,权威来源,证据充分。 |

| Potential | 6 | 极高潜力,几乎必然导致重大变化。 |

| Practicality | 4 | 高度实用,可直接应用于实际问题。 |

| Entertainment Value | 2 | 略显单调,但包含少量娱乐元素。 |