"Informed AI News" is an publications aggregation platform, ensuring you only gain the most valuable information, to eliminate information asymmetry and break through the limits of information cocoons. Find out more >>

Global Retirement Crisis: Challenges and Solutions

- summary

- score

People are living longer, healthcare costs are rising, and retirement savings are dwindling. In 1980, 60% of U.S. private sector workers had defined benefit pension plans—guaranteed retirement benefits. Today, only 15% do. The shift to defined contribution plans places the burden on retirees to save.

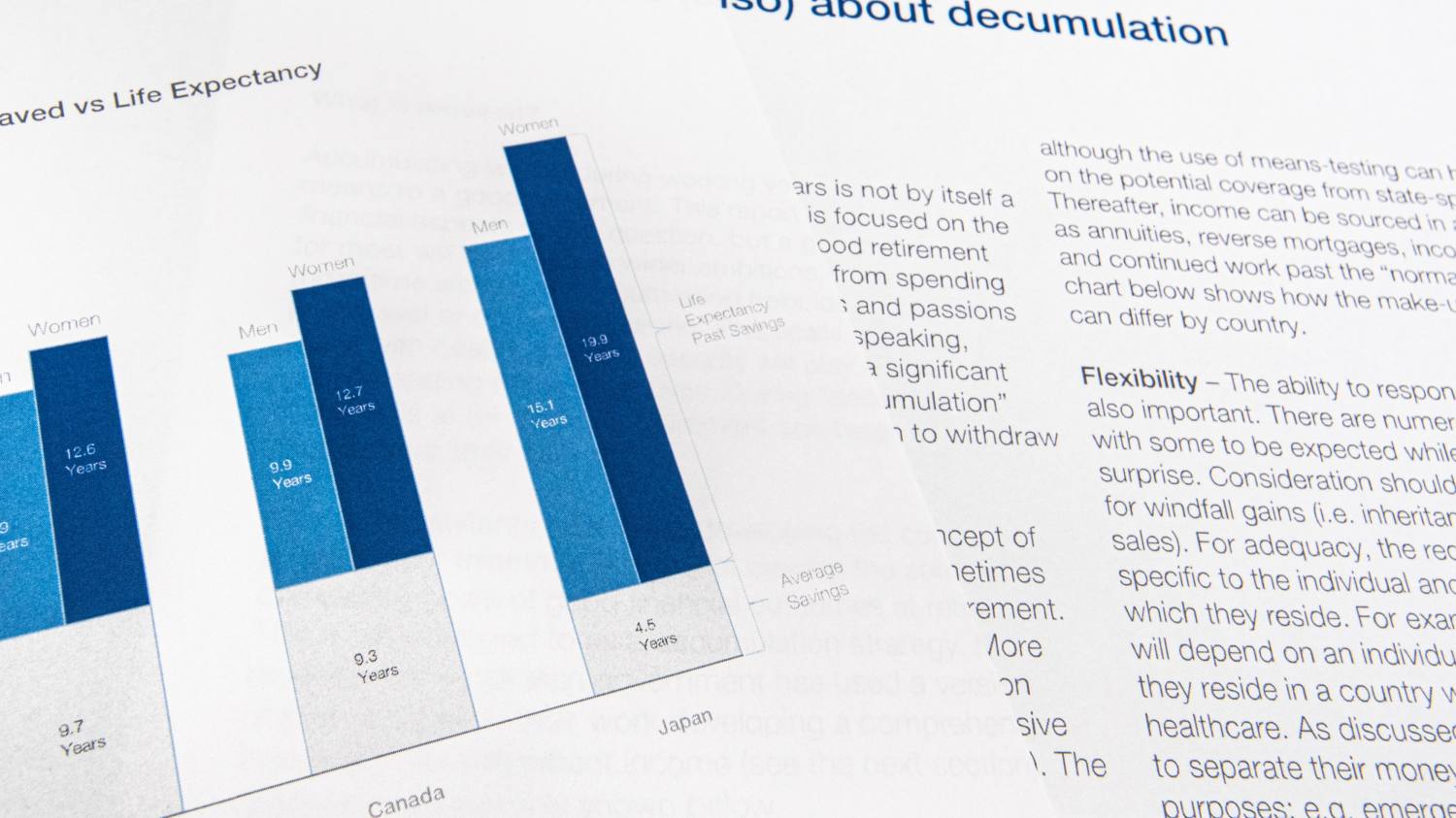

A quarter of non-retired Americans have no retirement savings. Morningstar predicts that nearly half of 65-year-olds will outlive their money. This crisis isn’t just in the U.S.—it’s global. In Asia, 70% of workers fear that finances prevent them from retiring. The World Economic Forum found that retirees in major economies could outlive their savings by 8 to 20 years.

Public pensions are strained. U.S. Social Security may run out by 2035, cutting benefits to 83%. Japan’s public pension system could reduce household income by 20% by 2058.

Henry Kravis, co-founder of KKR, believes that investment firms like his can help. KKR started with state pension funds, now reaching individual investors through innovative fund structures and annuities. Kravis expects this trend to grow, especially as asset classes become more accessible and yield needs intensify.

Key Terms:

- Defined Benefit Pension Plans: Plans that guarantee a specific retirement benefit.

- Defined Contribution Plans: Plans where the employer, employee, or both contribute to an individual account, with benefits based on contributions and earnings.

- Annuities: Financial products that provide a series of payments over a period.

- Mass Affluent Investors: Individuals with significant wealth but not in the ultra-high net worth category.

| Scores | Value | Explanation |

|---|---|---|

| Objectivity | 5 | Balanced reporting with comprehensive analysis. |

| Social Impact | 6 | Extensive and in-depth social discussion, major impact. |

| Credibility | 6 | Verified and confirmed by multiple sources. |

| Potential | 7 | Imminent social and policy changes. |

| Practicality | 5 | Widely applied in practice, good results. |

| Entertainment Value | 2 | Slightly monotonous, few entertaining elements. |